The Ultimate Guide to Leasing a Car in the UK - Who, When, Why and How?

Introduction: What is Leasing a Car?

Leasing a car is a way of financing the purchase of a vehicle. The consumer makes monthly payments and at the end of the lease term, they may have the option to buy their vehicle or give it back depending on the type of contract.

They are only required to pay for the monthly lease payments on time and in full. Most contracts offer an initial payment which is a payment made at the start of your agreement, normally calculated as either one, three, six, or nine times your monthly amount. You also get to choose the length of your contract and the amount of mileage per annum. Leasing a car in the UK is an alternative way of financing a vehicle that can be more affordable than buying one outright.

How is Leasing Different from Buying a Car?

A lease is a contract between two parties, the lessee and the lessor. The lessee is the individual who will be using the leased vehicle for a set period of time. The lessor is the individual or company who will own and maintain ownership of the property until the vehicle is returned or it has been paid off in its entirety.

The difference between leasing and buying a car is that when you buy a car you are purchasing it outright, paying for it in full with cash or financing. When you lease a car, you are paying for its use over time but not actually owning it at any point during your lease agreement.

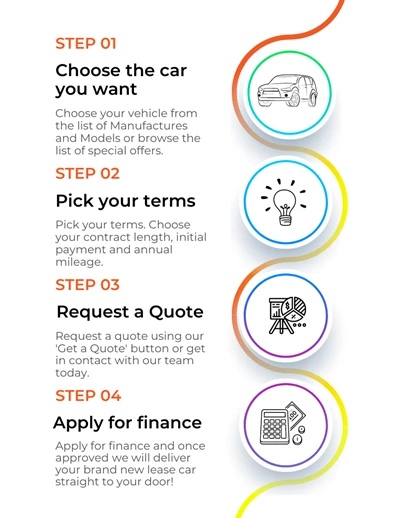

The Leasing Process - How to actually lease a car in the UK?

What are the Different Types of Vehicle Leases in the UK?

- Personal Contract Hire (PCH)

Personal Contract Hire, or PCH, is a long-term contract where customers pay a fixed monthly payment for a vehicle. Contracts are usually between two and five years in length and the contract is written in a private individuals own name.

Check out our Personal Contract Hire special offers!

- Business Contract Hire (BCH)

Business Contract Hire, or Business Leasing, is a long term lease agreement, between two and five years. Business Contract Hire is a popular way for businesses to fund new vehicles as it free's up cash flow that would not be possible when outright purchasing a car. In the UK, there are many tax benefits to leasing a car through your business or company. For example, if you use the vehicle for strictly business you can reclaim 100% of tax back from your lease, unfortunately, this doesn't include commuting to and from the office but it's not all doom and gloom as you can still reclaim 50% for personal journeys.

Check out our Business Contract Hire special offers!

Monthly lease payments for limited companies can be offset to lower your corporation tax and it's also good news if you're a sole trader or partnership as you can again offset the cost of leasing against the annual tax bill. However, there's also a few things to consider when taking out a business car lease, you will need to pay something called Benefit in-kind tax which is basically a tax for the added value of having a company car. Furthermore, if you're a business owner offering a company car to employees, you will be expected to pay a higher national insurance rate.

- Personal Contract Purchase (PCP)

This type of lease is similar to PCH where you pay in monthly payments however at the end of the lease, balloon payment is offered where the consumer can either choose to pay and own the vehicle or not pay and return the vehicle to the lease company.

When Should You Consider Leasing Your Next Car?

Leasing a car in the UK is a common option for many people. It is an alternative to buying or renting and you’ll likely get cheaper monthly payments over owning a car outright or renting.

It is cheaper in the short-term because you are only paying for the depreciation of the vehicle rather than paying for the full price of it upfront. However, you'll normally have to give the car back at the end or pay a balloon-payment to own the car.

There also may be other factors that will affect your decision on whether or not leasing is right for you, such as: how much money you have saved up, how much money your current vehicle costs, and what your credit score looks like.

Conclusion and Final Thoughts - The Bottom Line on Leasing Vehicles in the UK

Leasing a vehicle in the UK is a great way to keep costs down and it's also a good option for those who want to drive new vehicles every few years however you need to remember you won't own the vehicle.

The Bottom Line on Leasing Vehicles in the UK:

- Leasing vehicles is a great way to save money and also for those who would like to drive newer vehicles every few years.

- There are many benefits of leasing, including lower monthly payments, lower rates of depreciation, and tax advantages.

- You can lease any type of car or van from any Manufacturer!

Visit our FAQ page for the most commonly asked questions about leasing!